Custom Private Equity Asset Managers Things To Know Before You Get This

Wiki Article

Custom Private Equity Asset Managers for Beginners

(PE): investing in business that are not publicly traded. About $11 (https://custom-private-equity-asset-managers.mailchimpsites.com/). There might be a few points you don't recognize about the market.

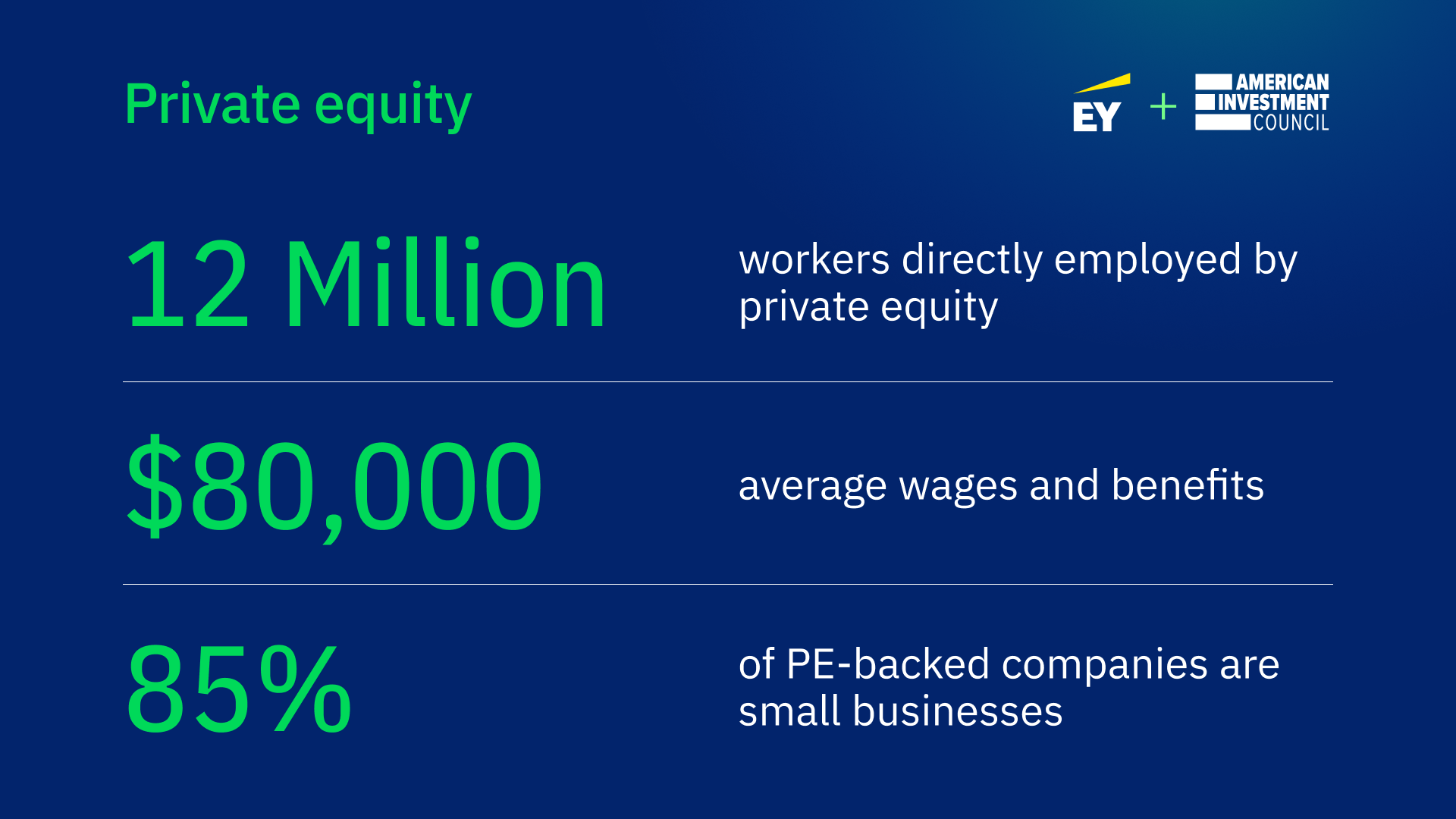

Companions at PE companies raise funds and take care of the cash to yield beneficial returns for investors, commonly with an financial investment perspective of between four and seven years. Private equity firms have a series of investment choices. Some are rigorous investors or easy financiers wholly dependent on monitoring to expand the business and produce returns.

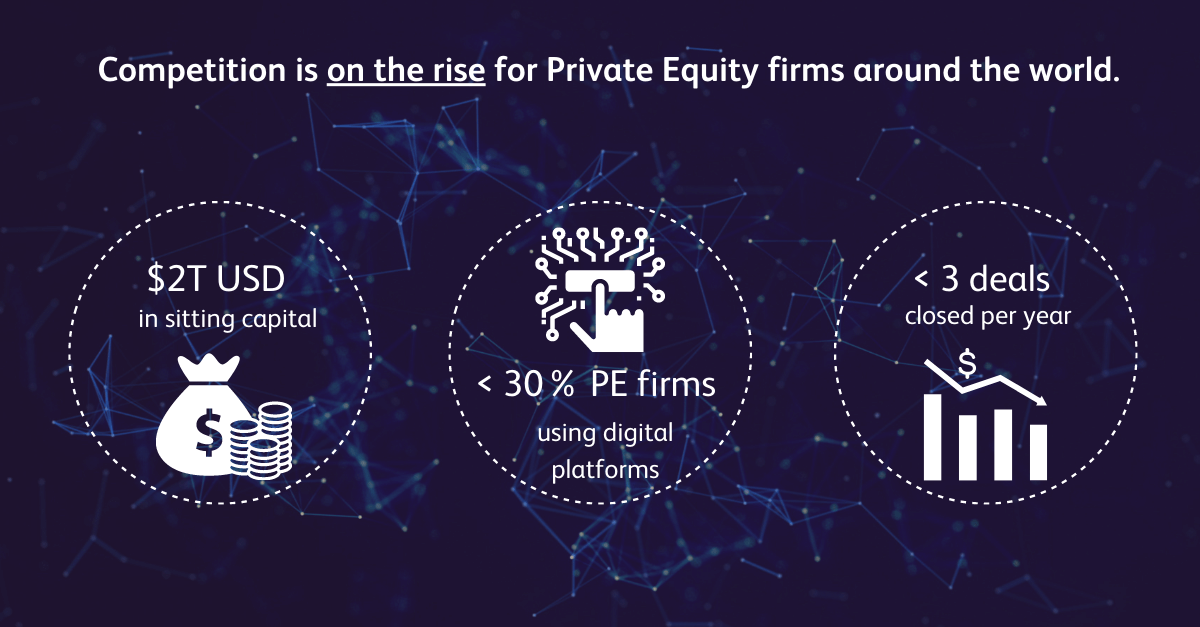

Due to the fact that the very best gravitate toward the larger offers, the middle market is a substantially underserved market. There are more sellers than there are highly experienced and well-positioned finance experts with extensive buyer networks and resources to handle a deal. The returns of exclusive equity are normally seen after a few years.

Not known Details About Custom Private Equity Asset Managers

Traveling listed below the radar of huge international firms, a lot of these tiny business commonly give higher-quality client solution and/or particular niche product or services that are not being this post provided by the huge corporations (https://cpequityamtx.wordpress.com/). Such benefits attract the passion of exclusive equity companies, as they possess the understandings and savvy to exploit such chances and take the firm to the following level

A lot of supervisors at portfolio companies are offered equity and bonus payment frameworks that reward them for striking their economic targets. Private equity opportunities are typically out of reach for individuals who can't spend millions of bucks, yet they shouldn't be.

There are policies, such as restrictions on the aggregate quantity of cash and on the number of non-accredited investors (Syndicated Private Equity Opportunities).

Indicators on Custom Private Equity Asset Managers You Should Know

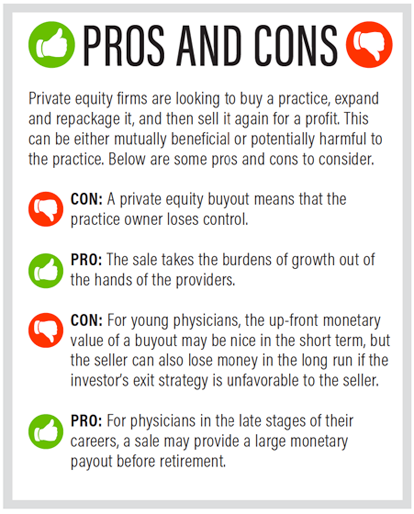

Another drawback is the lack of liquidity; when in a personal equity deal, it is hard to leave or offer. There is a lack of versatility. Private equity additionally comes with high charges. With funds under management already in the trillions, private equity companies have come to be attractive investment automobiles for well-off people and establishments.

Currently that accessibility to exclusive equity is opening up to more private financiers, the untapped potential is coming to be a truth. We'll start with the major debates for spending in exclusive equity: Exactly how and why private equity returns have historically been greater than other properties on a number of degrees, Exactly how consisting of private equity in a profile impacts the risk-return account, by helping to diversify against market and cyclical danger, Then, we will certainly describe some key considerations and threats for personal equity capitalists.

When it concerns introducing a new asset right into a profile, the many fundamental consideration is the risk-return profile of that asset. Historically, personal equity has actually shown returns similar to that of Emerging Market Equities and greater than all various other traditional asset courses. Its fairly reduced volatility coupled with its high returns makes for a compelling risk-return account.

Some Known Incorrect Statements About Custom Private Equity Asset Managers

Private equity fund quartiles have the largest variety of returns across all different possession classes - as you can see below. Methodology: Internal rate of return (IRR) spreads calculated for funds within vintage years individually and then averaged out. Median IRR was computed bytaking the average of the median IRR for funds within each vintage year.

The result of adding exclusive equity right into a portfolio is - as constantly - reliant on the profile itself. A Pantheon study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the ideal personal equity companies have accessibility to an also larger swimming pool of unknown chances that do not encounter the same analysis, as well as the resources to carry out due persistance on them and determine which are worth buying (Private Equity Platform Investment). Investing at the very beginning indicates higher risk, but also for the companies that do succeed, the fund take advantage of higher returns

The 45-Second Trick For Custom Private Equity Asset Managers

Both public and private equity fund supervisors commit to spending a percent of the fund yet there continues to be a well-trodden concern with aligning interests for public equity fund monitoring: the 'principal-agent problem'. When an investor (the 'major') employs a public fund supervisor to take control of their capital (as an 'representative') they entrust control to the supervisor while keeping ownership of the possessions.

When it comes to private equity, the General Companion doesn't just make a management fee. They also gain a percent of the fund's earnings in the type of "bring" (typically 20%). This makes sure that the rate of interests of the supervisor are straightened with those of the capitalists. Exclusive equity funds likewise minimize another type of principal-agent problem.

A public equity capitalist ultimately wants one thing - for the administration to raise the supply rate and/or pay out dividends. The capitalist has little to no control over the decision. We showed over just how several personal equity methods - particularly bulk acquistions - take control of the operating of the business, making sure that the lasting value of the firm comes initially, raising the roi over the life of the fund.

Report this wiki page